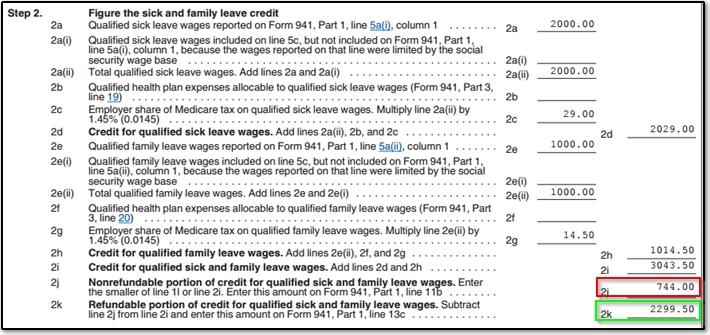

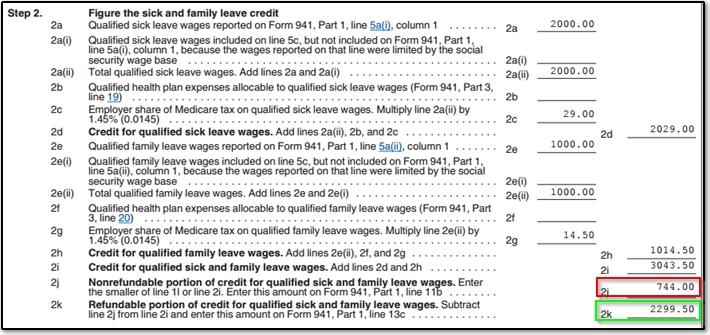

Enter qualified sick leave wages. Form 941 Worksheet 1 is used to calculate Refundable and Nonrefundable portions of qualified sick family leave employee retention credits this quarter.

Irs Releases Guidance On Employee Retention Credit Gyf

Irs Releases Guidance On Employee Retention Credit Gyf

The credit applies to wages paid after March 12 2020 and before January 1 2021.

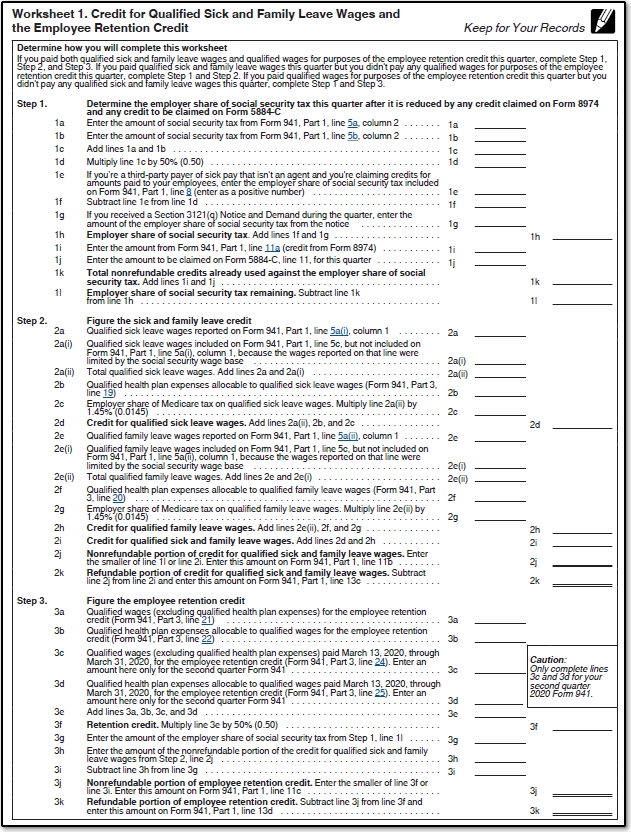

941 worksheet 1 employee retention credit. Form 941 Worksheet 1. 7272020 Beginning with the second quarter 2020 Form 941 the form has been updated to include Worksheet 1 on page 5. Step 1 - Determine the employer share of social security tax.

Now the IRS has issued the draft Form 941 instructions that include new Worksheet 1 for figuring the tax credits for the CARES Act employee retention credit andor the FFCRA paid leave credits. Then youll have to claim a credit under the Family First. This worksheet does not have to be attached to Form 941.

You should potentially use Worksheet 1 when claiming credits under the CARES Act and Employee Retention Credit for the second quarter of 2020 and beyond. Eligible wages per employee max out at 10000 so the maximum credit for eligible wages paid to any employee during 2020 is. Employee Retention Credit Worksheet 1.

This worksheet is broken up into three steps. 3102021 The worksheet for calculating coronavirus-related employment tax credits was updated in the finalized instructions for the 2021 Form 941 Employers Quarterly Federal Tax Return released March 9 by the Internal Revenue Service. You will enter the credit claimed on Form 5884-D on Worksheet 1 to figure your credit for qualified sick and family leave wages andor the employee retention credit.

Dont use an earlier revision of Form 941 to report. Join Larry Gray as he gives you guidance line by line. However it is a great tool for completing Form 941 for the second third and fourth quarters.

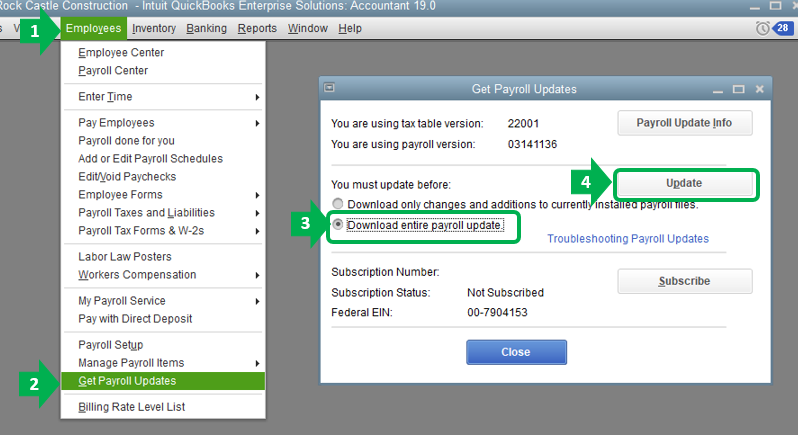

Thus any employer who files the Quarterly Employment Tax Form to the IRS under CARES Act and Employees Retention Credit should use this Worksheet. 1 accessing federal employment taxes including. First youll need to update your payroll tax table to ensure Worksheet 1 will populate.

In the new form there is a new Worksheet. For more information about this credit go to IRSgovForm5884D. Employee Retention Tax Credit on 941.

Both the Sick and Family Leave Credit and the Employee Retention Credit have a nonrefundable and refundable portion. If you are an employer who files the Quarterly Employment Tax Form to the IRS you should be aware of Worksheet 1. 3122020 The Form 941 is used to report income and social security and Medicare taxes withheld by the employer from employee wages as well as the employers share of social security and Medicare tax.

Ill ensure youre able to see Worksheet 1 in your 941 form ahncpa54. Claimed has been filed. For more information about this credit go to IRSgovForm5884D.

In anticipation of receiving the Employee Retention Credit Eligible Employers can fund qualified wages by. Read on to learn who is eligible for the Employee Retention Tax Credit ERC how to calculate ERC based on qualifying wages how to claim it and more. Form 941 Employers QUARTERLY Federal Tax Return filed by employers in the United States has seen multiple revisions this year due to the COVID-19 pandemicThe IRS initially revised Form 941 for quarter 2 2020 to accommodate the relief measures announced by the.

422021 How to calculate the Employee Retention Credit. The IRS has released the new 941 Payroll Tax Form for 2020. 1022020 Form 941 Worksheet 1 is designed to accompany the newly revised Form 941 for the second quarter of 2020 and beyond.

To generate Worksheet 1 leave the box labelled Credit for Sick Leave. Credit for Qualified Sick and Family Leave Wages and the Employee Retention Credit. It is necessary to complete Worksheet 1 before preparing the Form 941.

For 2020 the Employee Retention Credit is equal to 50 of qualified employee wages paid in a calendar quarter. 4102020 IRS re-issues Form 941 employee retention credit The IRS has re-issued Form 941 Employers Quarterly Federal Tax Return for 2020 and the related instructionseach with a note providing guidance for employers claiming the newly enacted employee retention credit that allows a tax credit to certain employers operating a business during 2020 that is negatively. You can earn a tax credit of up to 33000 per employee in wages paid under the Employee Retention Credit ERC if your business was financially impacted by COVID-19.

IRS Form 941 Worksheet 1 - Explained. Form 941 Worksheet 1 for 2021. Blank but in the next section down enter 100 in Additional Items.

Updated on March 15 2021 - 1030 AM by Admin ExpressEfile. Claiming a credit for qualified sick and family leave wages andor the employee retention credit in that quarter you must include any credit that will be claimed on Form 5884-D on Worksheet 1 for the Form 941 for that quarter. Reminders If a line on Form 941-X doesnt apply to you leave it blank.

Worksheet 1 is used to calculate the amounts of the credits for qualified sick and family leave wages and the employee retention credit. To help business owners calculate the tax credits they are eligible for the IRS has created Worksheet 1. 442021 Report Inappropriate Content.

How To Use Form 941 Worksheet 1 And Why Taxbandits Youtube

How To Use Form 941 Worksheet 1 And Why Taxbandits Youtube

2020 Form 941 Employee Retention Credit For Closed Businesses Due To Covid 19 Part 1 Of 11 Youtube

2020 Form 941 Employee Retention Credit For Closed Businesses Due To Covid 19 Part 1 Of 11 Youtube

Https Www Dhscott Com Wp Content Uploads 2021 01 Form 941 Worksheet Pdf

Draft Of Revised Form 941 Released By Irs Includes Ffcra And Cares Provisions Current Federal Tax Developments

Draft Of Revised Form 941 Released By Irs Includes Ffcra And Cares Provisions Current Federal Tax Developments

Https S3 Amazonaws Com Mentoring Redesign Score Ertc Guidance 1 18 2021 Pdf

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Https S3 Amazonaws Com Mentoring Redesign Score Ertc Guidance 1 18 2021 Pdf

Https Www Morganlewis Com Media E88fb0dcaadf4a699229f411df239e47 Ashx

How To Amend 941 To Claim Employee Retention Credit

How To Amend 941 To Claim Employee Retention Credit

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Irs Releases Draft Coronavirus Payroll Tax Credit Forms

Https Www Morganlewis Com Media E88fb0dcaadf4a699229f411df239e47 Ashx

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Guest Column Employee Retention Tax Credit Cheat Sheet Repairer Driven Newsrepairer Driven News

Guest Column Employee Retention Tax Credit Cheat Sheet Repairer Driven Newsrepairer Driven News

Https Www Morganlewis Com Media E88fb0dcaadf4a699229f411df239e47 Ashx

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das